CURATOR Wystan Curnow OTHER VENUE Govett-Brewster Art Gallery, New Plymouth, 1 February–15 March 1992 SPONSORS Rutherford Art Trust, Queen Elizabeth II Arts Council, Armourguard, Saatchi and Saatchi

Apple's art provokes and confronts the contradictions in our culture's view of the relation between art and money ... it is never just for sale, but proposes a relationship which commits both parties to make something of the transaction, because you never buy just an Apple but must buy into his system.

—Wystan Curnow

In 1959, Barrie Bates leaves New Zealand, on a National Art Gallery scholarship, to study at London’s Royal College of Art. There, he joins other students—including David Hockney and Derek Boshier—who will lead a new wave of British pop art. In 1962, he bleaches his hair and eyebrows and changes his name to Billy Apple, reinventing himself as a brand. After this, much of his work will play off this brand, like an extended advertising campaign. In 1964, he moves to New York, where he becomes part of the American pop-art scene, then the American conceptual-art scene. During this time, he works in advertising, which informs his art.

Returning to live in New Zealand in 1980, Apple produces a new body of work, highlighting art's place in the market. Many of the works look like enlarged receipts or bills of sale, declaring their status as Sold, Auctioned, Exchanged, Bartered, Commissioned, and even N.F.S. (not for sale). Many are co-signed by the other party in the transaction—the collector. Indeed, the collector's involvement completes the work.

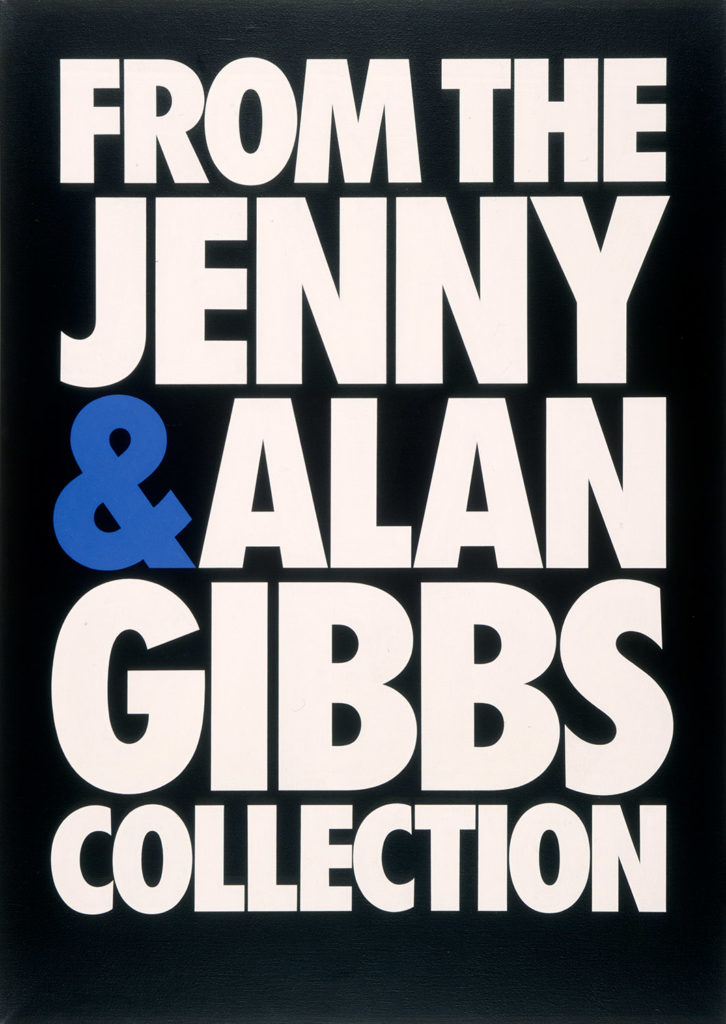

Apple’s From the Collection works are commissions, produced to order, transacted before being produced. Featuring explanatory words—like From the Hunter Collection or From the Tony Petrie Collection—they recall the language used on exhibition labels when works are lent to museum shows, declaring their owners' good names. These canvases could be seen as individual and corporate portraits. For example, From the BNZ Collection (1998) is rendered in the Bank’s corporate colours. Brought together for the show, Apple’s From the Collection works are a collective portrait of a sector of society, those happy to mix their brands with Apple’s.

Apple's Transactions are conceptual. They refer to art’s place as a commodity in the marketplace, the art system. They are also pop. The paintings are beautifully done, executed by Auckland master sign writer Terry Maitland, fetishising their impersonal 'commercial' finish.

Several works refer to gold, both as a unit of economic value and as a mythic substance. Golden Apple (1983) is a 103oz 22-carat gold apple. It was commissioned by Ray Smith, founder and chairman Goldcorp Auckland Coin and Bullion Exchange, which soon after went belly up. A partnership with Armourguard ensures securing the Apple in the show by day and its removal each night.

The works in The Golden Rectangle Series (1988) are printed on gold-passivated steel. Each is a set of pieces of steel of ever smaller dimensions that together form a rectangle. Their relative proportions are determined by the ‘golden section’, which has long been thought to define ideal proportion. Two works feature texts by critic Wystan Curnow, one referring to gold in economics, another to gold in mythology.

A long-term collaborator, Curnow is the curator of the show. He describes himself as Apple’s ‘critic and his minder’; a reviewer calls him ‘Apple’s equivalent of his stockbroker’. The show acknowledges his role in the transaction.

Advertising agency Saatchi & Saatchi get in on the act, creating a self-referential ad campaign for the show, which echoes Apple’s approach.

Some, especially those with a romantic idea of art, are critical, but most commentators admire Apple's ingenuity. One claims: ‘So forget about the funny old notion of art for art’s sake. It doesn’t get a look in. It’s a market-driven art world, and Billy Apple has it perfectly sussed. Laughing, you might say, all the way to the bank.’